The European Single Electronic Format (ESEF) will be mandatory starting from January 1, 2020. According to the regulation of the European Commission, all issuers whose financial instruments are admitted to trading on the European Union market will be required to prepare their annual financial reports in XHTML format and mark consolidated financial statements prepared in accordance with IFRS using the XBRL (eXtensible Business Reporting Language) markup language – in accordance with adopted taxonomies and principles. More details can be found in the regulation – http://ec.europa.eu/transparency/regdoc/rep/3/2018/PL/C-2018-8612-F1-PL-MAIN-PART-1.PDF

ESEF – XBRL reporting, iXBRL

The European Single Electronic Format (ESEF) will be mandatory starting from January 1, 2020. According to the regulation of the European Commission, all issuers whose financial instruments are admitted to trading on the European Union market will be required to prepare their annual financial reports in XHTML format and mark consolidated financial statements prepared in accordance with IFRS using the XBRL (eXtensible Business Reporting Language) markup language – in accordance with adopted taxonomies and principles. More details can be found in the regulation – http://ec.europa.eu/transparency/regdoc/rep/3/2018/PL/C-2018-8612-F1-PL-MAIN-PART-1.PDF

For regulators, such a solution will ensure comparability of reports while enabling their automatic reading. With the use of appropriate software, analyzing company reports will be more qualitatively and quantitatively efficient – resulting in better and faster data interpretation, and consequently, market transparency.

For companies, especially for those responsible for financial reporting, this will unfortunately be another challenge. Although there is still plenty of time until 2020, to ensure data comparability, it is “worthwhile” to have data prepared in the same standard for the previous year! Nothing is as certain as change (and changing regulations), so this challenge will also need to be addressed.

Guidelines for the scope of XBRL marking required by the ESMA ESEF XBRL reporting program are as follows:

- In the case of the first stage commencing with respect to financial statements with a start date of January 1, 2020, or later, consolidated primary financial statements prepared in accordance with IFRS (income statement, balance sheet, etc.) must be extensively marked with the XBRL tag,

- In the case of the second stage commencing with respect to financial statements with a start date of January 1, 2022, additional information to these financial statements must be marked by applying labels for entire sections of additional information (block tagging).

Fortunately for companies, technology comes to the rescue in this case as well (especially since neither XHTML nor XBRL are anything new and have been used in business for years).

See how Cogit supports the construction of a report compliant with ESEF. Thanks to the right tools, everything can be made simpler:

- tagging positions,

- building and validating a package of taxonomy extensions,

- validation of the report against the taxonomy,

- generation and validation of the report in iXBRL format.

Our consultants have analyzed many solutions available on the market in this area to ultimately choose Report Authority

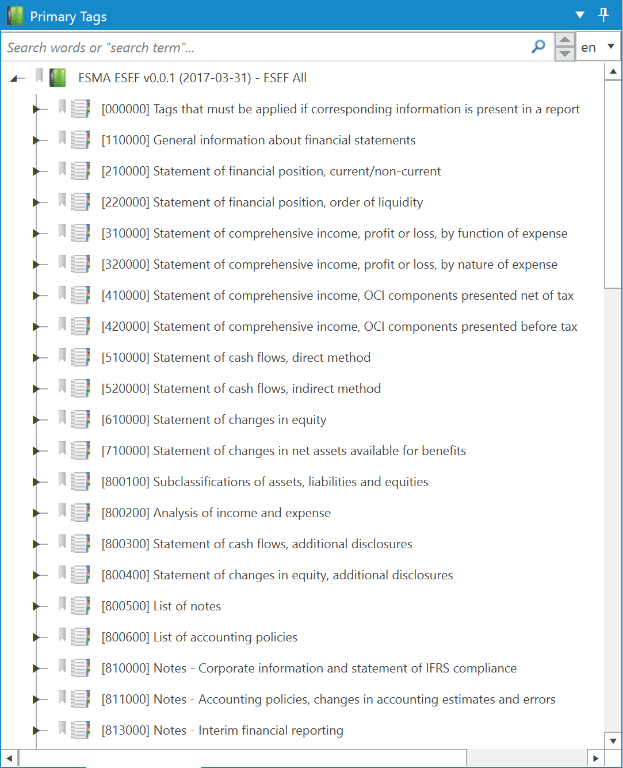

ESMA ESEF XBRL Taxonomies

The solution used includes the ESMA ESEF taxonomy, which is an extension of the full IFRS taxonomy.

The ESEF taxonomy is flexible and can be extended by reporting entities in case reported facts do not correspond to any tags in the taxonomy.

You can both browse all available taxonomies and create user extensions to taxonomies. There are 28 validation rules:

- 10 conditions checking the presence of tags (mandatory tags); and

- 18 conditions checking values.

XBRL tags must be embedded in an xHTML document using Inline XBRL (iXBRL) technology, which can be opened using standard web browsers and can be prepared and displayed according to the issuer’s intentions.

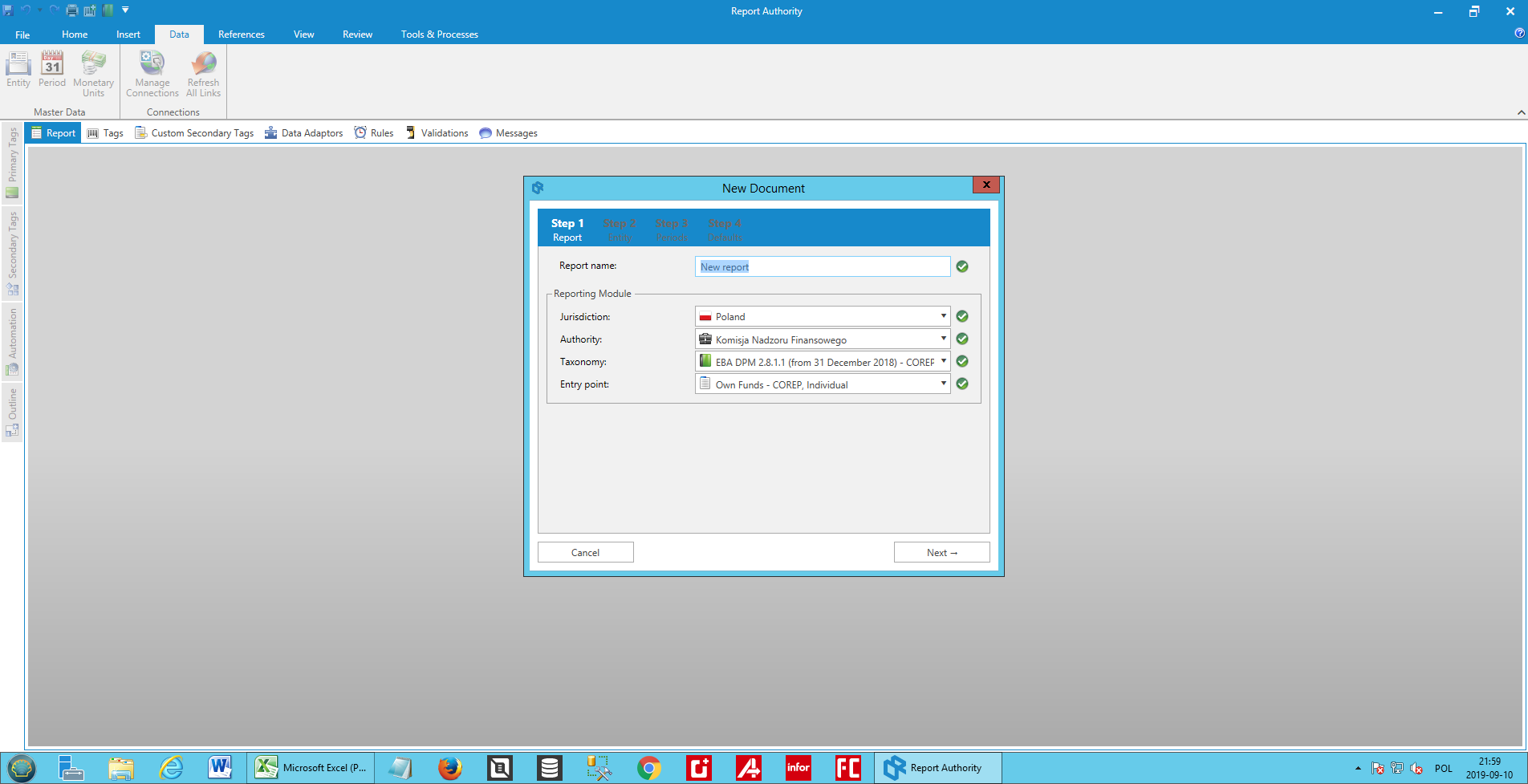

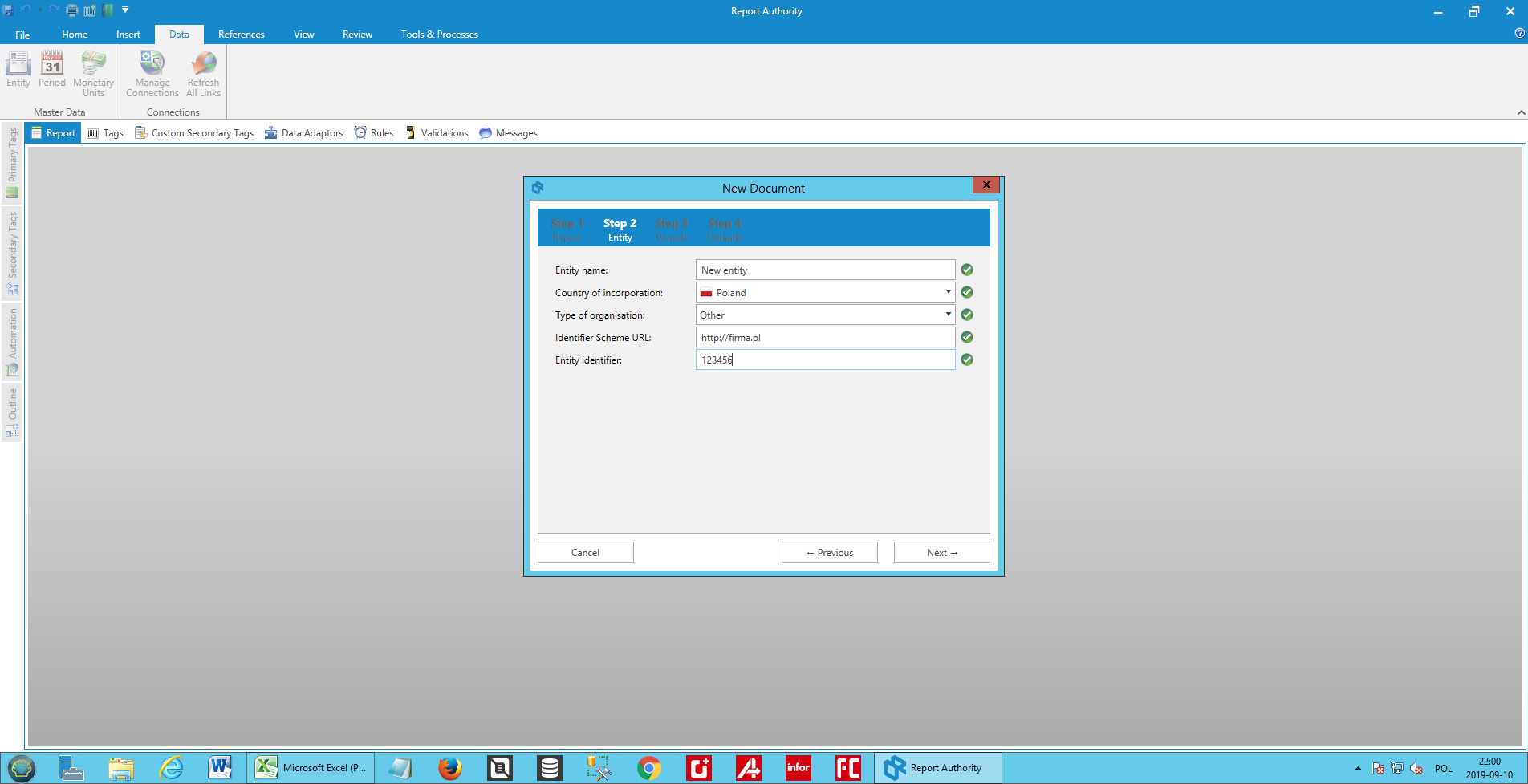

Simplifying XBRL Reporting

The solution is designed by accountants for accountants and minimizes any known complications associated with the introduction of XBRL reporting. It is a tool that will help an accountant in preparing and automating sets of financial reports; the system can successfully integrate XBRL with the financial reporting process with minimal effort.

Convert or Create

If your annual financial reports have already been prepared but you need an iXBRL version, you can import entire Microsoft Word documents or content from Excel spreadsheets to be tagged as XBRL and converted to iXBRL format. This is useful if;

- you need reports from previous periods in iXBRL format before implementing the system;

- or you don’t have control over the creation of annual financial reports.

Alternatively, you can use the entire set of system features to create, automate, validate, and replicate annual financial reports from within the system.

Effective and Consistent Reporting

Companies that must submit reports under the ESMA XBRL reporting program may be required to present multiple iXBRL reports to their local regulatory authorities – one for each entity in the group. This can be a significant burden for financial teams because;

- manual tagging of XBRL for each entity is time-consuming and;

- it is difficult to achieve consistency of content and XBRL tagging across all entities in the group.

The template functionality of the system reduces these problems, as the content, XBRL tags, and segment data mapping can be specified using a template – any changes will cascade automatically and consistently to all entities in the group.

Reliable Reporting

Will your submission be accepted by the local regulatory authority? With the interactive validation feature of the system, you will know the answer to this question immediately.

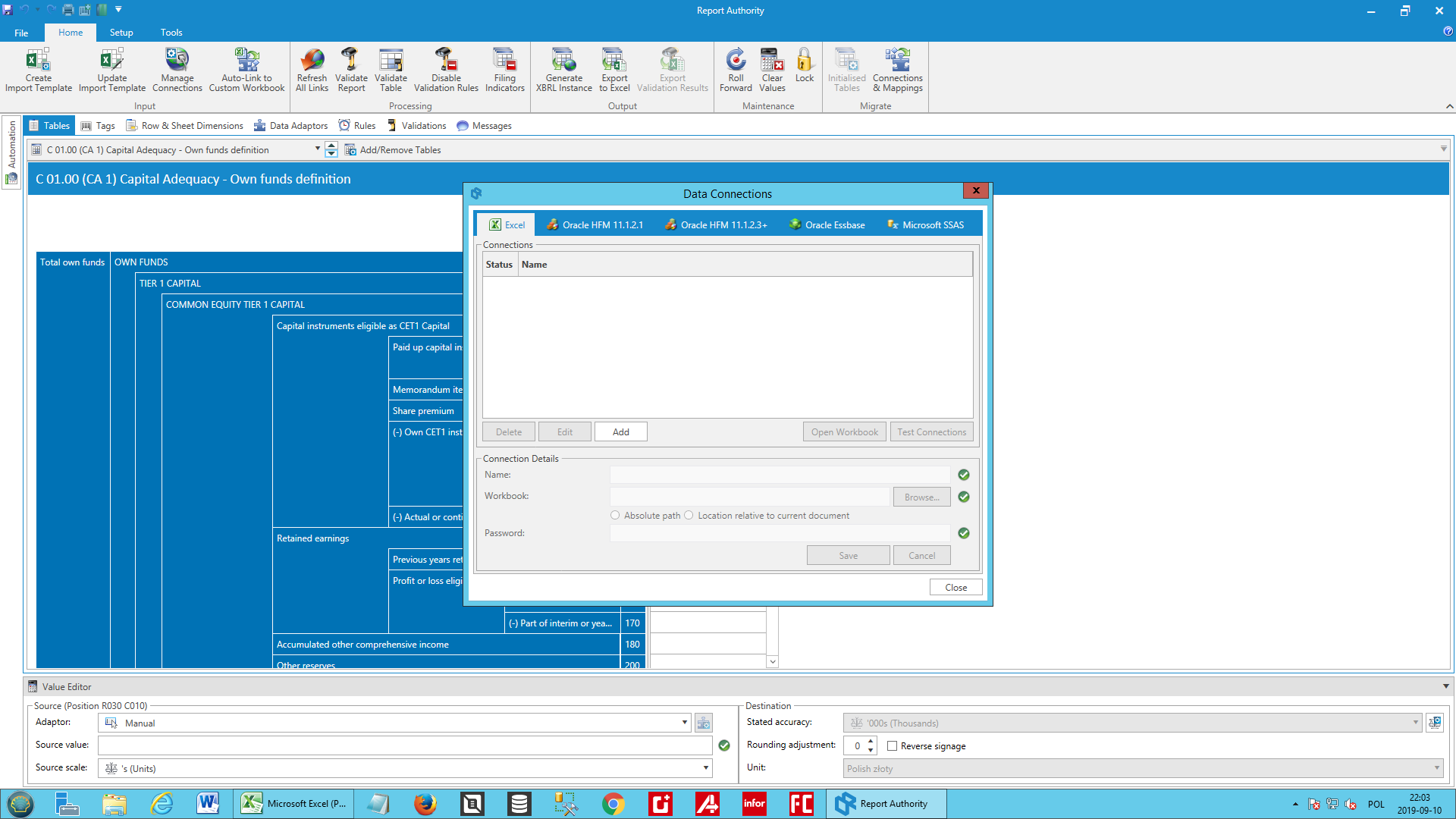

Integration with Hyperion and More

Automate your annual financial reports by combining facts in the report with external data sources, such as Oracle HFM, Planning & Essbase, and Microsoft Excel.

Contact us and explore the possibilities of tools supporting reporting in ESEF format – info@cogit.pl or call us at +48 22 496 60 00.