The subsidiaries and business divisions that make up global enterprises trade with each other constantly, generating high volumes of intercompany accounting transactions. When performing the month or year-end financial close, disputes over balances owed to and from entities within a company can dramatically increase costs and take up valuable time. Today, organisations need to manage the disruption caused by intercompany reporting in terms of improving the following challenges:

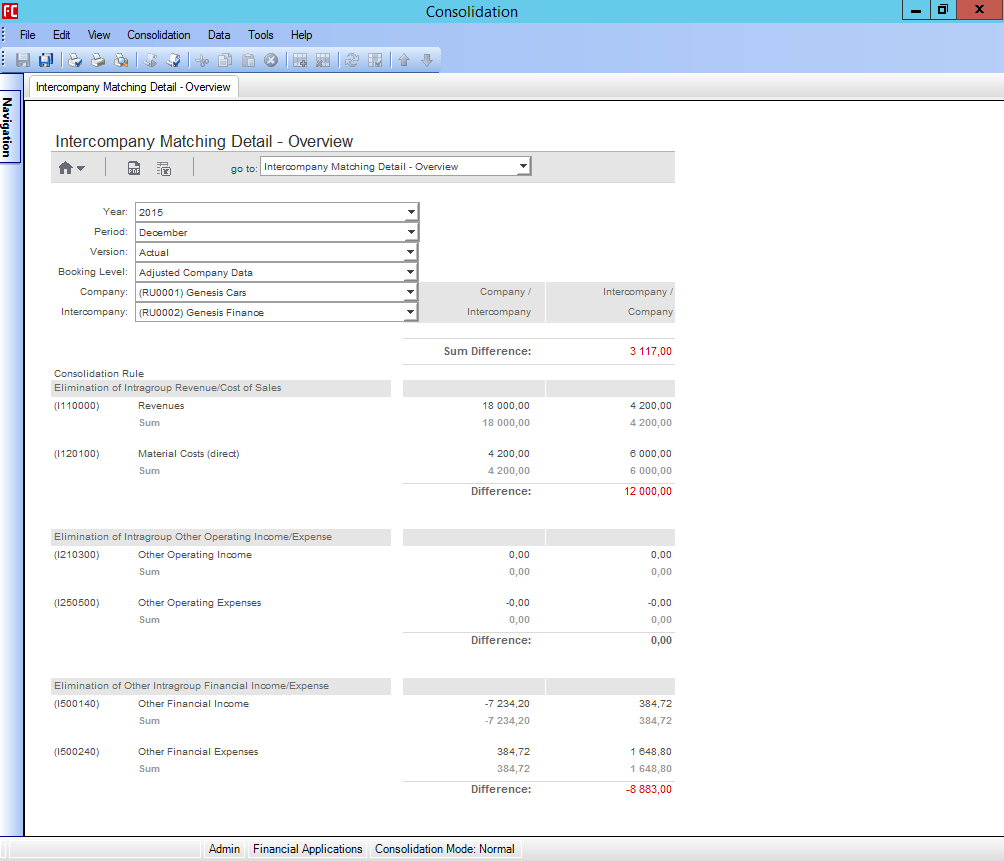

Manual processes: To manually post transactions twice or have staff in each subsidiary entering information separately lead to unreliable data and possible data duplication. Manual intercompany reconciliation processes also increase the risk of reconciliation errors where differences can often be overlooked, resulting in financial losses and delays to reporting.

Multiple Enterprise Resource Planning (ERP) systems: operating in different geographical locations with different data structures and currencies can lead to inefficiencies, making it more difficult for managers to monitor results and detect issues throughout the year.

Reporting: can also be problematic since the data comes from distinct but coordinated modules, and might not be readily available in a standard format leaving the inability to monitor the results and intercompany profit allocations effectively.

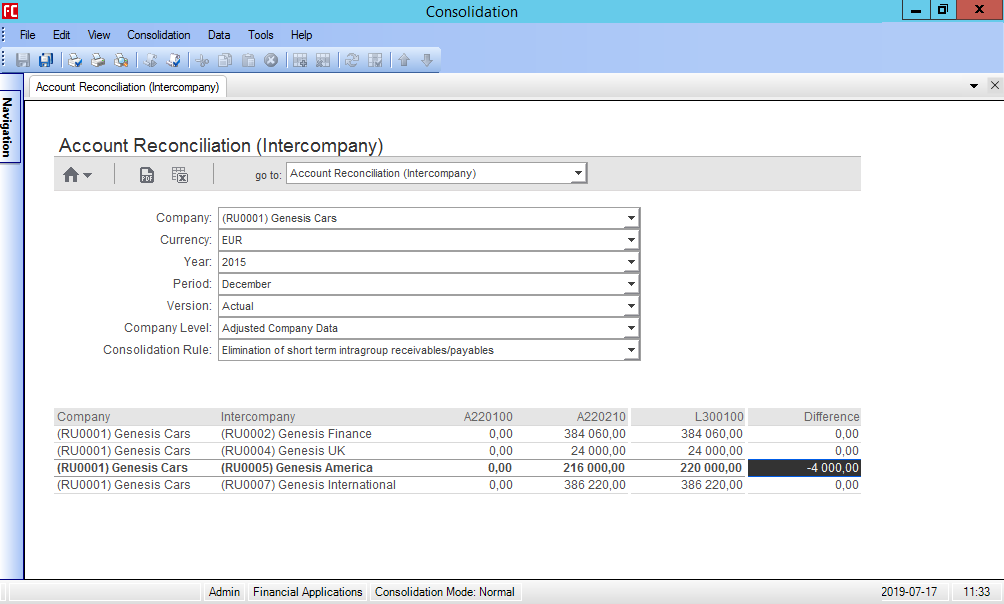

Reconciliation: The challenges with intercompany reconciliation are usually due to a lack of clarity or communication between departments. Additionally another issue faced by many companies is intercompany charges where subsidiaries are changed based upon their working capital. Most of these issues are due to lack of top-down policies such as:

- General reconciliation practice

- Responsibility for reconciliation

- Specific format for reconciliation

- Responsibility for internal control

- Transfer pricing

- Foreign currency

- Intercompany cut-off policies

- Formal confirmation procedure

- Dispute resolution

All of these processes must comply in accordance with tax policy and accounting requirements.