Certent Disclosure Management – modern, automated ESEF/XBRL reporting. Faster. Smarter. Safer.

What is ESEF?

Since January 1, 2020, all companies listed on regulated markets in the EEA are required to prepare their annual financial statements in the European Single Electronic Format (ESEF). This means:

- Reports must be published in XHTML format,

- Consolidated IFRS financial statements must also be tagged in XBRL / iXBRL, ensuring easy comparability across companies.

The challenges

- Manual, time-consuming processes (copying data between Excel, Word, PowerPoint).

- High risk of errors, inconsistencies, and non-compliance with disclosure requirements.

- Strict deadlines combined with the need to maintain publication quality.

- Ensuring security, compliance, and full auditability of data.

The solution: CDM for ESEF

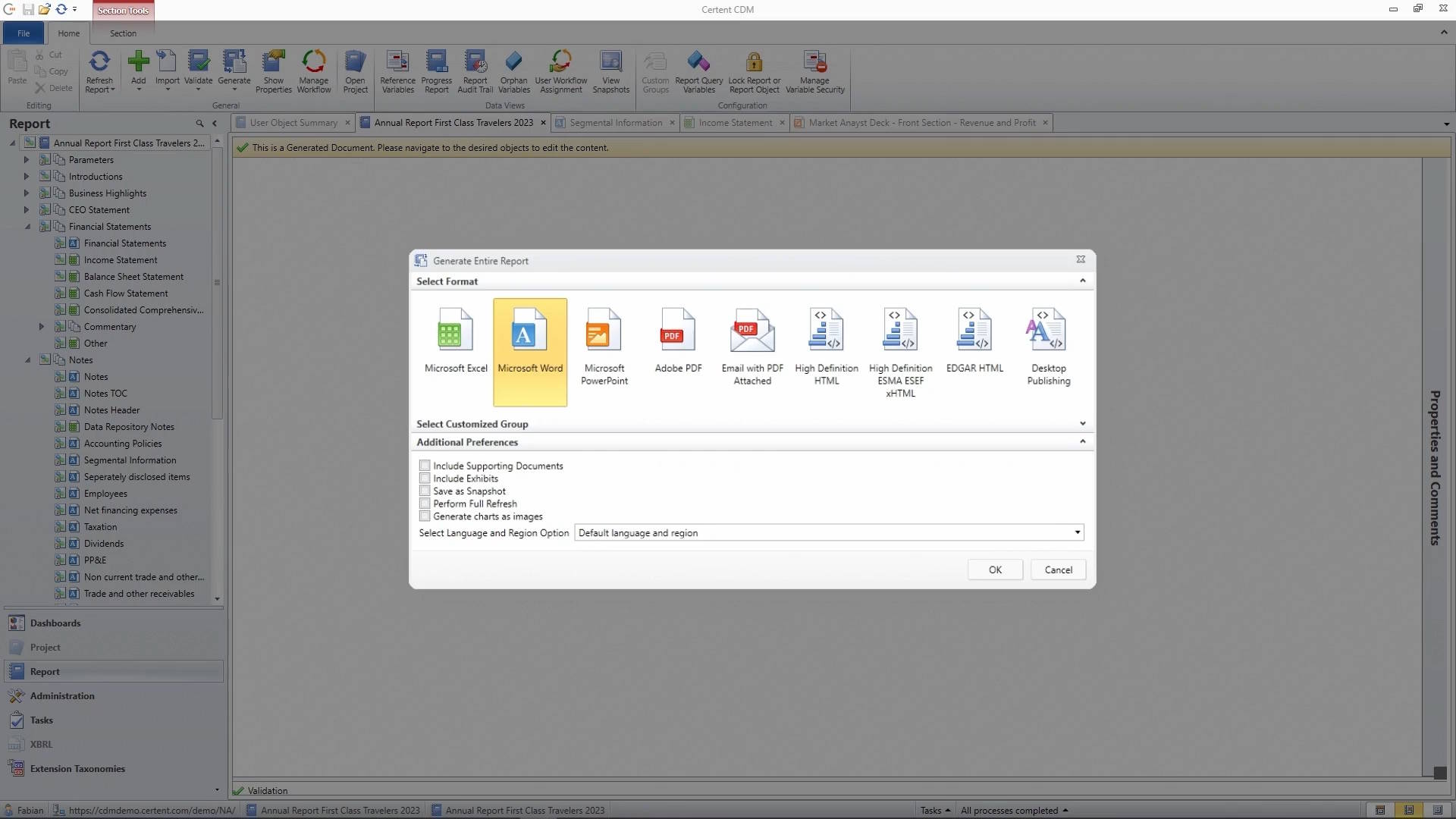

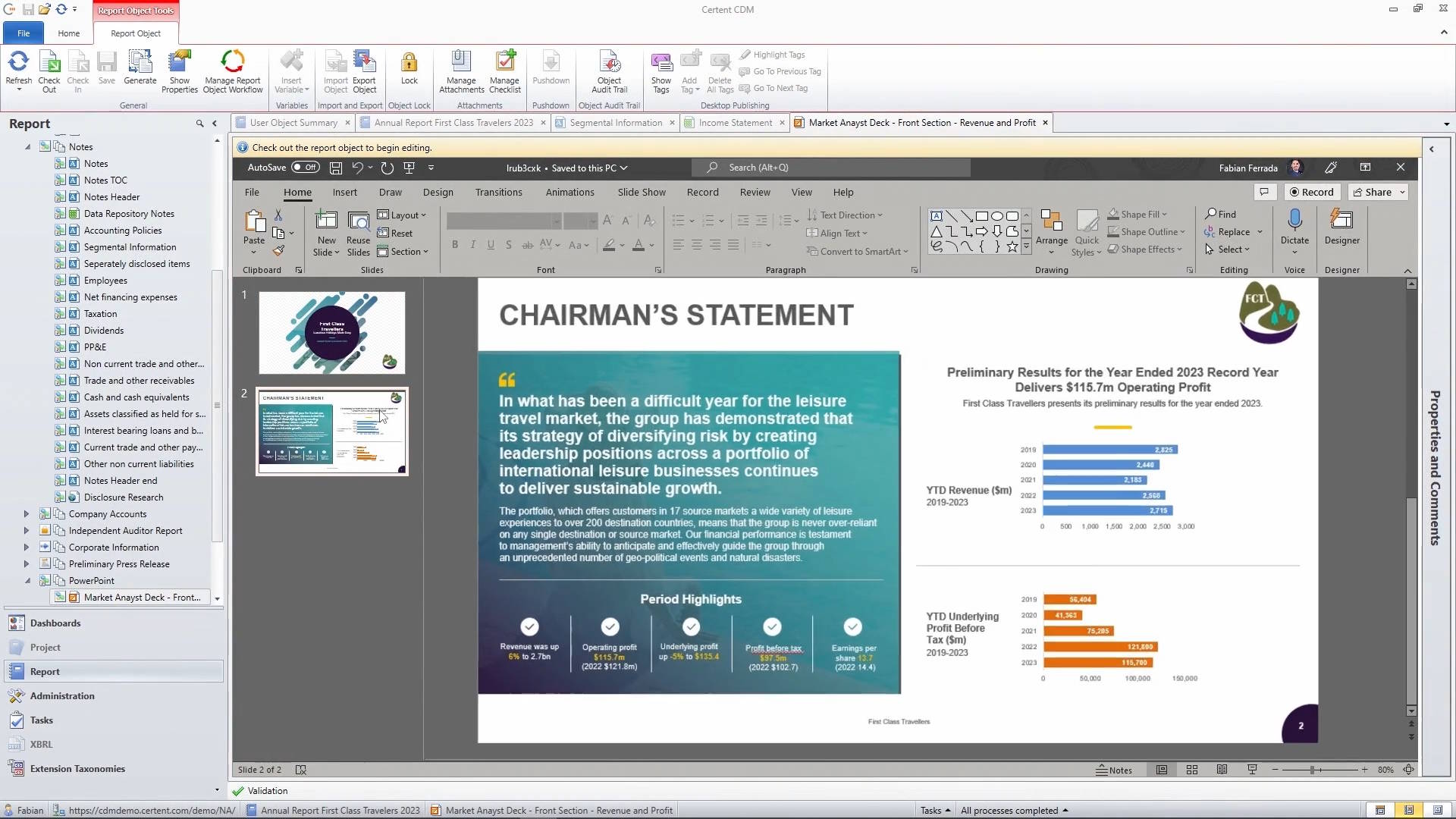

CDM (Certent Disclosure Management) is an end-to-end platform for financial reporting that streamlines and automates the preparation of fully ESEF-compliant statements. It integrates seamlessly with Microsoft Office (Word, Excel, PowerPoint), allowing finance teams to work with the tools they already know and trust.

Key benefits and features:

- Automated XBRL/iXBRL tagging – compliant with ESMA taxonomy, with the option to use other taxonomies as needed.

- One-click export to XHTML – ready for regulatory submission.

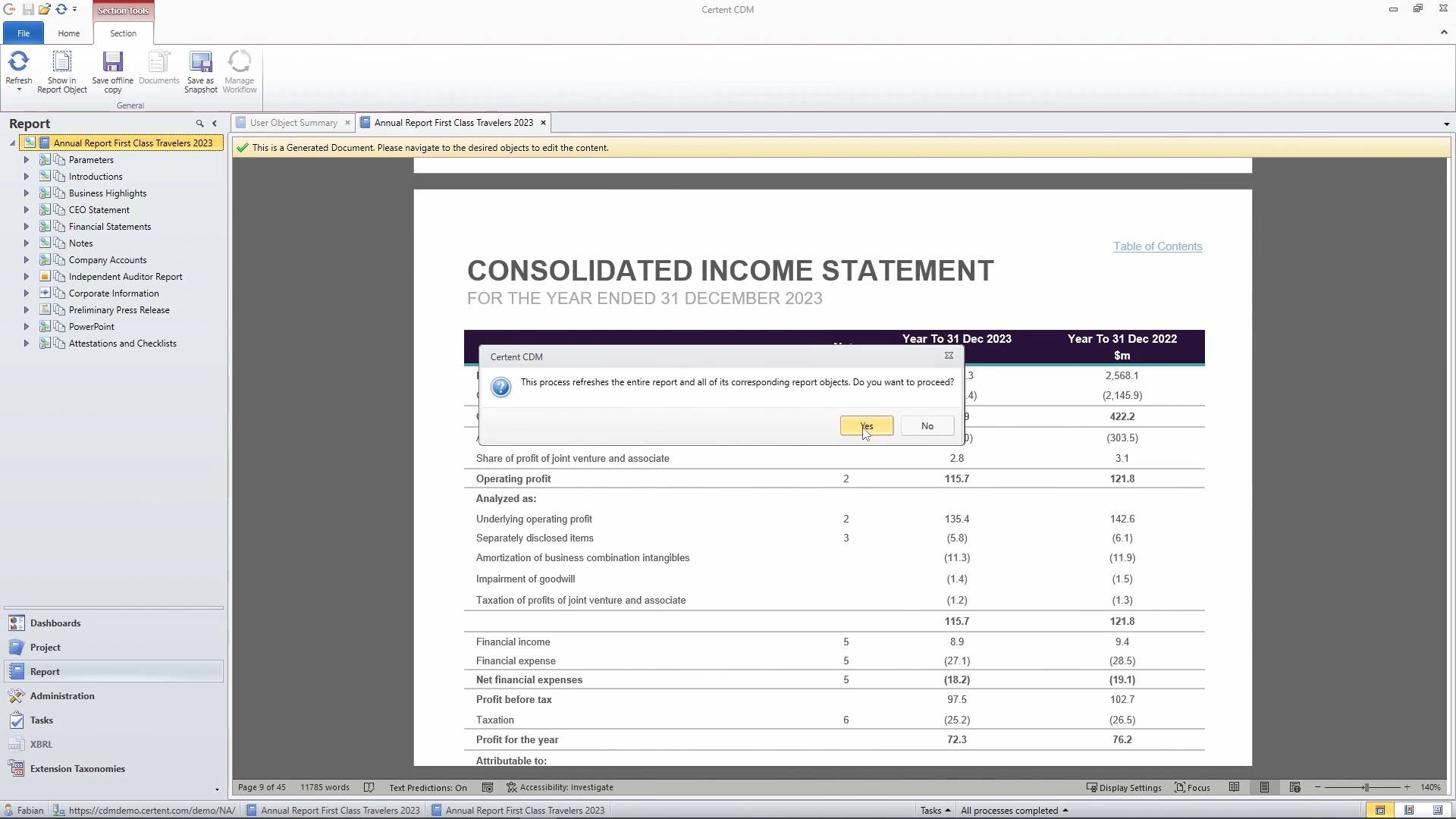

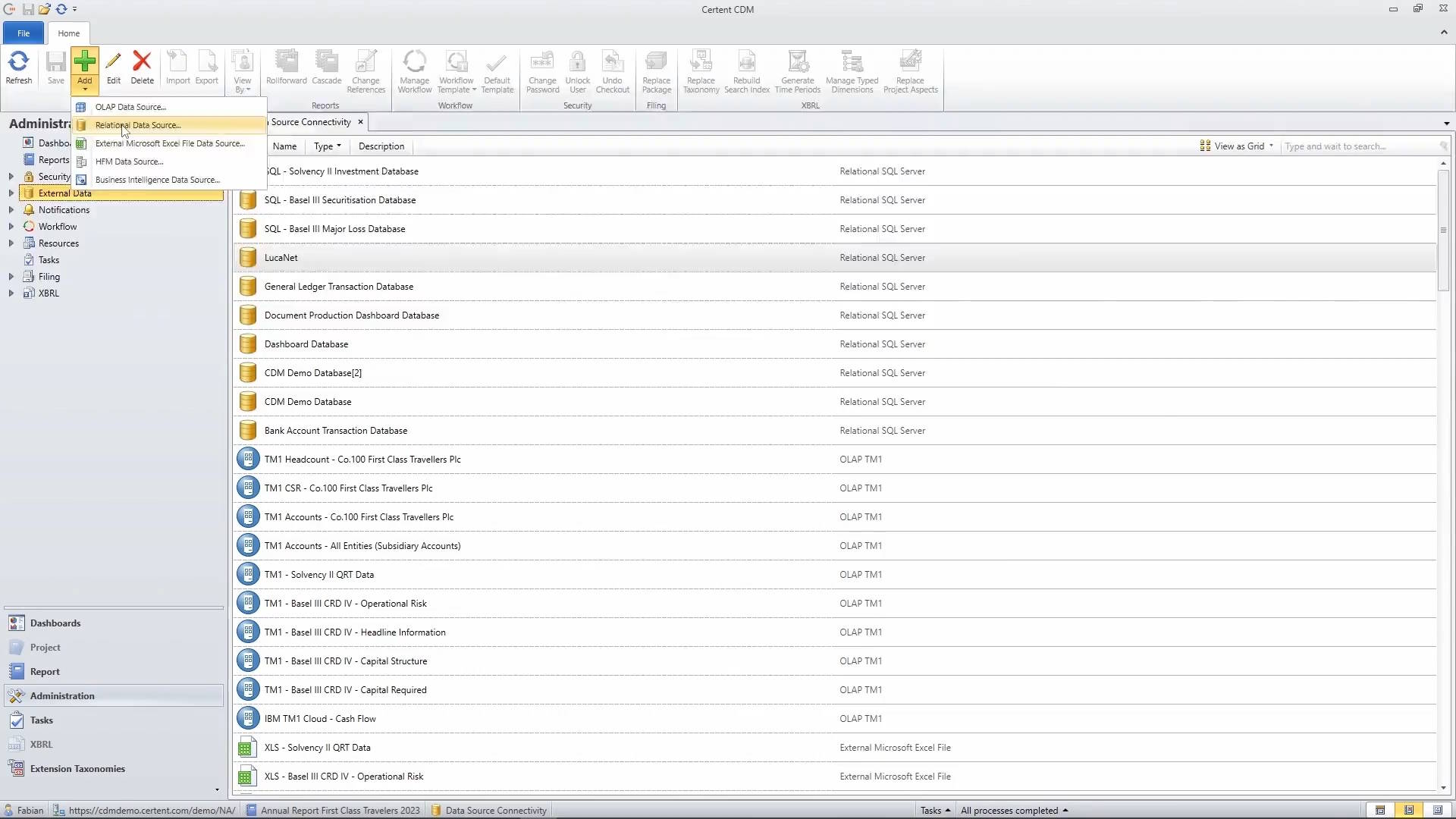

- Live data integration – reports update instantly as source data changes.

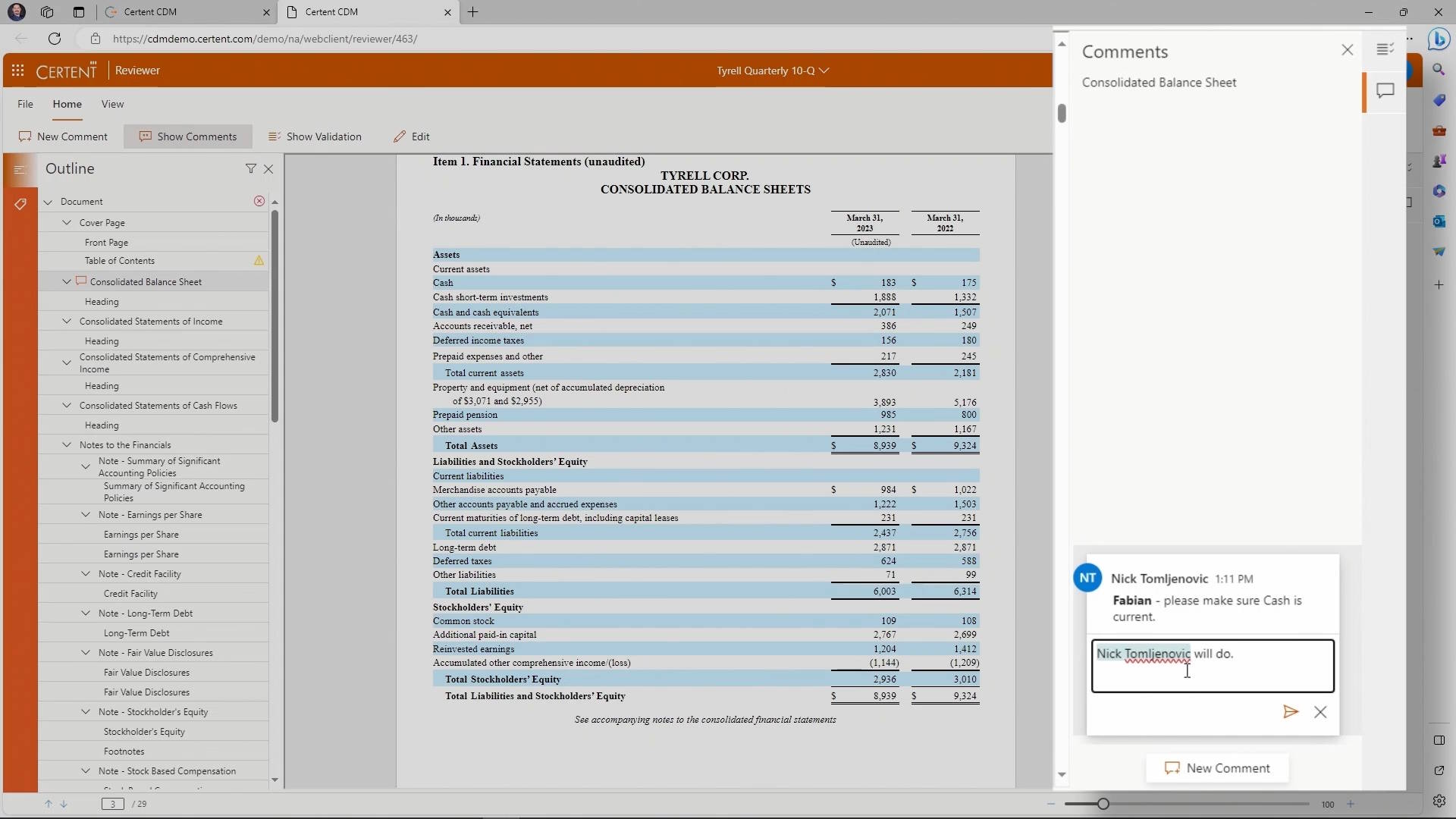

- Single source of truth – the whole team works on one consistent version.

- Full control & audit trail – track changes, validate, and secure your data.

- Office-native integration – Excel, Word, PowerPoint plus CPM systems (TM1 Planning Analytics, HFM, Essbase).

- High-definition reporting – preserve the look and feel of reports while remaining fully Inline XBRL compliant.